On ABC News on Sunday night, Alan Kohler in his regular spot showed how business investment, especially in plant and equipment, has been sluggish for the past several years. Despite acknowledging a number of theories, of course he blamed it on the lack of a coherent bi-partisan climate policy- his favourite hobby-horse.

Time for a reality check.

Firstly, Figure 1 shows the Australian All Ordinaries Index with the key dates of proposal, adoption, deferral, re-proposal, and eventual scrapping of all versions of carbon tax, with the 2014 and 2019 elections when Labor’s climate dreams were roundly rejected. It is important to realise that various Federal and State renewable energy incentives have also been introduced during this time.

Figure 1: All Ordinaries Index 2007-2022 (per Westpac)

The share market seems to have been largely oblivious to climate policy. What about business investment?

I checked the recently released ABS data, here and here.

Alan Kohler used 3 data points (decadal annual growth rates). I looked at the 124 quarterly values of private investment in 2021 dollar values, from March 1991 to December 2021.

Figure 2: Quarterly Private Capital Investment, 1991-2021

While Construction boomed from 2011 to 2015, it is true that investment in plant, equipment, and machinery has barely moved since 2010.

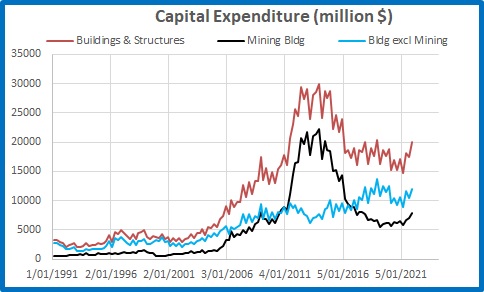

These categories can be further broken down into Mining and all others except for mining:

Figure 3: Capital Investment in Construction, Mining and Non-mining

That big bump was the mining boom, which also shows but to a lesser extent in investment in Plant and Equipment:

Figure 4: Capital Investment in Plant & Equipment, Mining and Non-mining

Note that the total figure for Plant and equipment is nearly all from non-mining activity. Note the peak was reached in the December quarter of 2009, before the big reduction brought about by the GFC of 2008 and 2009.

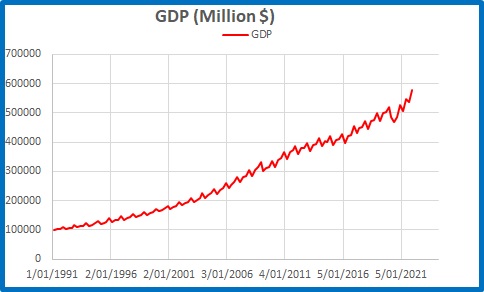

Rather than annual growth or actual quarterly investment, an alternative comparison is with GDP.

Figure 5: Australia’s Gross Domestic product

Despite the sluggish early 1990s, the GFC and the pandemic, GDP has been growing at an increasing rate, especially in the last five years.

Figure 6: Quarterly Private Capital Investment as a percentage of GDP, 1991-2021

Mining investment in construction has been huge, and the economy has been reaping the benefit since 2016.

Figure 7 shows investment in plant and equipment (which Alan Kohler says has been flat since 2011 as a result of not having certainty in climate policy) outside the mining industry. The dates from Figure 1 are shown.

Figure 7: Quarterly Plant and Equipment Investment as a percentage of GDP, 1991-2021

Alan Kohler’s explanation is obviously wrong. Perhaps he could explain why plant and equipment expenditure relative to GDP has been steadily decreasing since 1996- well before any mention of climate policy. That would seem to be a much more serious problem.

But I don’t think he will- there’s an election coming up.